risk premium prada | prada growth risk premium prada Prada S.p.A’s turnaround strategy — which is centered around an elimination of markdowns, higher average selling price and more control over the distribution with directly . Profile Analytics for Alexis Maltais. Discover Premium. With a Premium subscription, you'll get access to over 30 tools, features and benefits.

0 · prada selling price

1 · prada sales growth

2 · prada sales

3 · prada growth

4 · prada financial news

5 · prada business news

6 · prada advertising strategy

7 · is prada a scam

Alaska's unique spirit and identity. Alaska’s National Historic Landmarks are special places that illustrate powerful stories of conflict and achievement. Alaska is the gateway for the earliest Americans 14,000 years ago and is home to generations of ancient and present-day Arctic cultures.

Prada S.p.A’s turnaround strategy — which is centered around an elimination of markdowns, higher average selling price and more control over the distribution with directly . Burberry‘s plight is in part related to steep price rises, showing that the trend towards premiumisation has become harder to pull off. But the real breakout star of this .

Prada’s pricing strategy plays a crucial role in positioning the brand as a symbol of luxury and exclusivity. The company employs various pricing tactics to cater to its global . The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian . The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian .

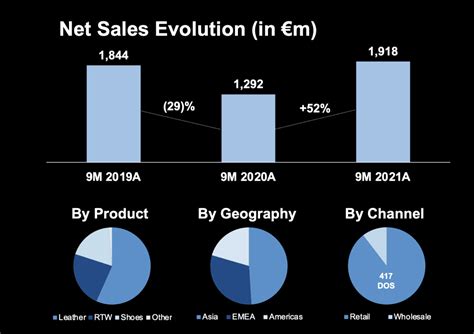

Prada sales bounced back sharply in 2021 as pent-up demand for luxury handbags and clothes helped push revenues above pre-pandemic levels, the Italian fashion group said.This article delves into how Prada and Miu Miu are successfully defying market trends by aligning their celebrated logos with deeper, resonant values. Discover the strategic finesse that . Prada Group says sales climbed 41 per cent last year as it sold more products at full-price, adding to the rapid recovery of luxury’s largest players. The Italian luxury owner of .

The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian workshops and . Prada stands out in the luxury market with double-digit revenue growth and rising net margins, justifying its premium stock valuation. See more on PRDSF stock. The equity risk premium is the premium investors expect to make for taking on the relatively higher risk of buying stocks. The ERP averaged about 5% from 1928 to 2022. Investopedia / Michela Buttignol

Competitive Comparison of Prada SpA's WACC % For the Luxury Goods subindustry, Prada SpA's WACC %, along with its competitors' market caps and WACC % data, can be viewed below: * Competitive companies are chosen from companies within the same industry, with headquarter located in same country, with closest market capitalization; x-axis shows the .

prada selling price

5. Interpreting Risk Premium. Risk premium is a critical concept in finance and investment analysis.It represents the additional return that investors demand for taking on risk beyond the risk-free rate. In this section, we'll delve into the intricacies of interpreting risk premium, exploring different perspectives and providing practical insights.金融文献中的Risk Premia 和Risk Premium有什么区别呢? 请问risk premia 和 risk premium有什么区别,中文应该怎么翻译呢? 显示全部 Calculation of Equity Risk Premium. There are several methods for calculating the ERP, including the historical method, the dividend discount model, and the implied ERP method. Each method has its advantages and limitations, and investors may use different approaches depending on their specific needs and investment objectives.The US treasury bill (T-bill) is generally used as the risk free rate for calculations in the US, however in finance theory the risk free rate is any investment that involves no risk. Risk Premium of the Market. The risk premium of the market is the average return on the market minus the risk free rate. The term "the market" in respect to .

From 1928 to 2022, the U.S. ERP averaged 5.06%, compared with 4.6% for the 1871-1925 period and 2.9% for the earlier 1802-1870 period. From 1926 to 2002, the equity risk premium was particularly high at 8.4%, which puzzled economists. From 2011 through 2022, the average market risk premium in the U.S. was 5.5%.Prada SpA's Weighted Average Cost of Capital (WACC) is calculated as the weighted average of its cost of equity and cost of debt, adjusted for tax. The WACC stands at 6.47%. This includes the cost of equity at 6.74%, calculated as Risk-Free Rate + Beta x ERP, and the cost of debt at 4.09%, reflecting the interest rate on Prada SpA's debt adjusted for tax benefits.

One of the most important concepts in bond investing is the bond risk premium, which measures the extra return that investors demand for holding a risky bond over a risk-free asset. The bond risk premium reflects the compensation for various sources of uncertainty and risk that affect the bond's cash flows and price. understanding the bond risk premium is .

Risk Premium = Rate of Return Risk-Free Rate of Return. Example of a risk premium. Lets say you want to invest in Company ABC. You can calculate the risk premium of the company using the above formula. Lets say the company had a return of 8% over the past year. During that same period, lets say the rate on a U.S. Treasury was 2.75%. These tools can also incorporate various economic indicators and market conditions, offering a more nuanced calculation of the market risk premium. Factors Influencing Market Risk Premium. The market risk premium is not a static figure; it fluctuates based on a myriad of factors that reflect the broader economic environment and investor sentiment. The equity risk premium represents the additional return investors expect from holding stocks, above what they could earn from risk-free investments like bonds or Treasury bills. This premium .Risk premia refers to the amount by which the return of a risky asset is expected to outperform the known return on a risk-free asset. Equity market exposure is the best-known risk premium, rewarding investors for taking exposure to long-only equity investments. Other risk premia include the size factor, where small-cap stocks tend to outperform large-cap stocks, and the value .

Size risk premium is the additional return that investors expect to earn by investing in small-cap stocks compared to large-cap stocks. Small-cap stocks are generally riskier than large-cap stocks, and therefore, investors demand a higher return to compensate for the additional risk. Prada S.p.A’s turnaround strategy — which is centered around an elimination of markdowns, higher average selling price and more control over the distribution with directly-owned stores and online — is paying off. Burberry‘s plight is in part related to steep price rises, showing that the trend towards premiumisation has become harder to pull off. But the real breakout star of this reporting season —. Prada’s pricing strategy plays a crucial role in positioning the brand as a symbol of luxury and exclusivity. The company employs various pricing tactics to cater to its global audience and drive revenue growth. First and foremost, Prada implements premium pricing, offering high-quality products at a premium cost.

The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian workshops and factories . The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian workshops and factories, according to Patrizio. . Prada and the family’s holding company recently spent over 0 million to expand its New York presence with the .

Prada sales bounced back sharply in 2021 as pent-up demand for luxury handbags and clothes helped push revenues above pre-pandemic levels, the Italian fashion group said.This article delves into how Prada and Miu Miu are successfully defying market trends by aligning their celebrated logos with deeper, resonant values. Discover the strategic finesse that enables Prada to navigate luxury retail's challenges with unparalleled elegance Prada Group says sales climbed 41 per cent last year as it sold more products at full-price, adding to the rapid recovery of luxury’s largest players. The Italian luxury owner of Prada and Miu Miu said 2021 revenues rose to €3.36 billion (.8 billion) in a statement today.The risk for Italy is getting sidelined as decision-making shifts to Paris, London and New York, even though some 80% of luxury goods sold globally pass through Italian workshops and factories .

prada sales growth

Tickets, money, passport, enable roaming. Check! To use your ALDImobile overseas you'll need to enable roaming. Log in to your online account, click 'international roaming' from the manage account menu and select your preference. We recommend you do this at least a week before you travel.

risk premium prada|prada growth